A recent survey showed that over 40% of small and medium enterprises have requested a business loan to support their business. Out of this 40% that asked to take such loans, another 30% weren't allowed or given such loans due to their low credit score. Regardless of how big or small a business is, owners can't personally use their finances to run such businesses, hence using loans to support such ventures.

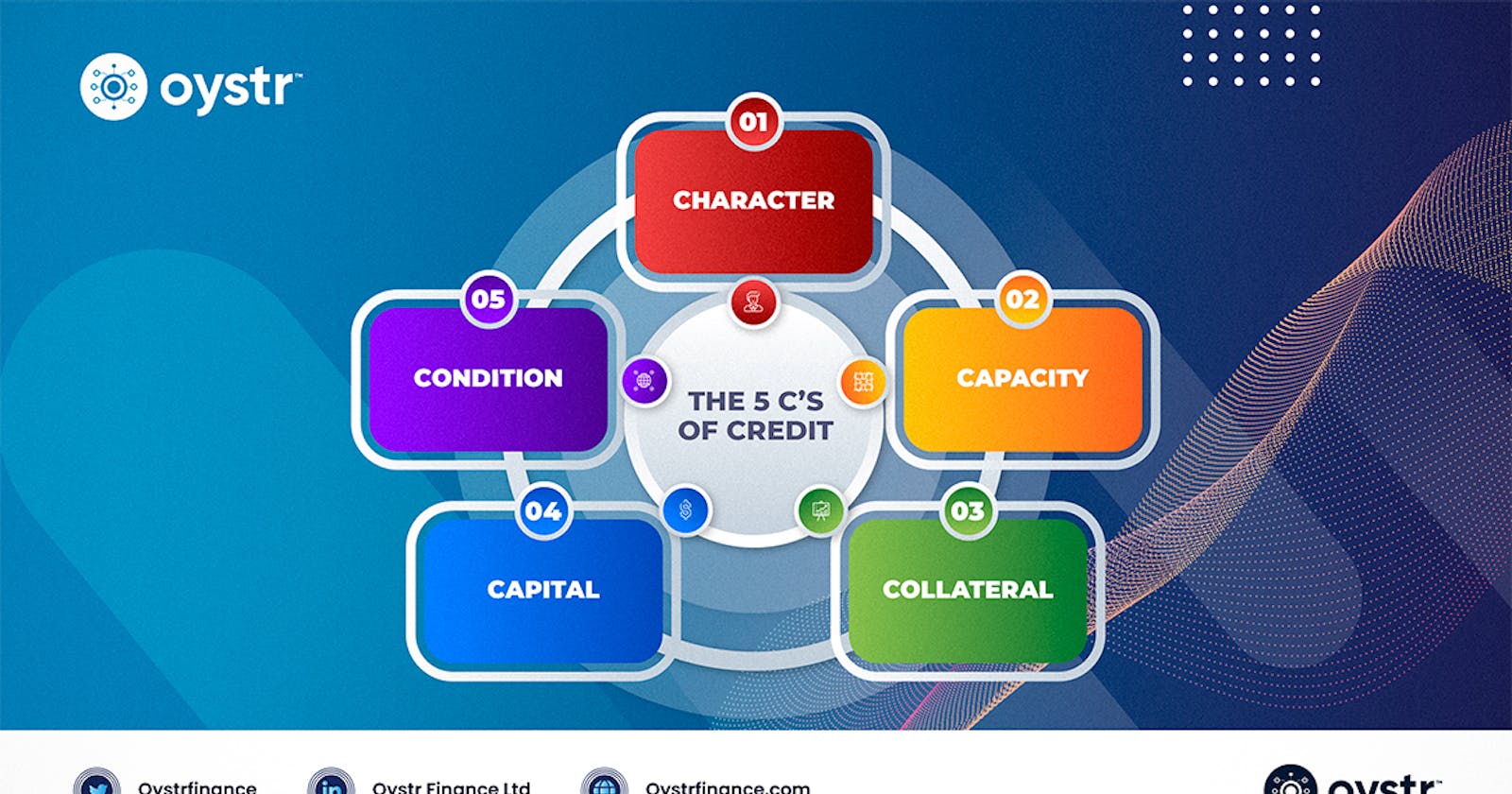

Over the years, lenders have devised and used five strong towers to determine a business'/applicant's creditworthiness. A thorough understanding of these pillars of credit increases the chances of success in getting such business loans granted.

The Five Pillars explained

Lenders employ the "5 Cs of credit" system to assess an applicant's creditworthiness. It would be perilous for the lender to lend money to the small business owner if they believe they are likely to go into default or be unable to repay the loan. As a result, the borrower would only receive some of the requested funds. The borrower will get a loan if they are considered creditworthy and low-risk.

The five pillars of credit are not equally important to all lenders. Depending on their lending criteria, some lenders may place more emphasis on one post than another. For example, a lender lending to a small business may emphasize the borrower's character and capacity more than their collateral.

Character

Perhaps the most important of all the pillars. Lenders want to know that borrowers are trustworthy and reliable and that they will repay their debts. Character is typically determined by factors such as:

Payment history: Lenders look at how borrowers have paid their bills. A history of late or missed payments is a red flag for lenders.

Outstanding debt: Lenders want to know how much debt borrowers have and how much they can afford to repay. A high debt-to-income ratio will make it easier for borrowers to get approved for loans.

Bankruptcy or other negative marks: A default or different negative impact on a borrower's credit report can make it challenging to get approved for loans.

A good-character borrower is more likely to repay their debts on time and in full. They are also less likely to default on a loan or file for bankruptcy. It makes them a lower risk for lenders, and they may be able to get approved for loans with better terms.

Capacity

It refers to your ability to repay a loan. To determine your capacity, lenders will consider your income, expenses, and debt-to-income ratio.

Your income is the amount of money you earn each month. Lenders will want to see that you possess a steady income sufficient to cover your monthly expenses and the monthly payments on the loan you are applying for.

Your monthly expenses are the amount of money you spend on housing, food, transportation, debt payments, and other necessities. Lenders will want to see that your expenses are reasonable compared to your income.

Your debt-to-income ratio is the percentage of your monthly income that goes towards debt payments. Lenders typically want a debt-to-income ratio of no more than 36%.

In addition to your income, expenses, and debt-to-income ratio, lenders may also consider other factors when assessing your capacity, such as your employment history, job stability, and other financial obligations.

If you can prove beyond doubt that you can repay a loan, you will likely get access to a loan with favorable repayment terms.

Capital

Capital refers to the borrower's assets, such as savings, investments, and property. Lenders look at a borrower's capital to assess their loan repayment ability.

A borrower with much capital is generally considered a lower risk than a borrower with little money. It is because the borrower with more capital has more resources to draw on if they default on the loan.

Borrowers can do a few things to increase their capital and improve their creditworthiness. One is to save money. Another is to invest in assets, such as real estate or stocks. Borrowers can also reduce their debt, which will free up more capital.

By increasing their capital, borrowers can make themselves more attractive to lenders and improve their chances of getting approved for a loan.

Collateral

When you borrow money, you are essentially taking a lending risk. The lender is taking a chance that you will not repay the loan, and you are taking a risk that you will not be able to afford the monthly payments. Collateral is an asset you pledge to the lender if you default on the loan. If you default, the lender can seize and sell the collateral to recoup their losses.

Collateral is an integral part of the credit lending process. It helps to reduce the risk for lenders and makes it more likely that you will be approved for a loan. The type of collateral you can offer will depend on the lender and the kind of loan you are applying for. Some common types of collateral include:

Real estate: This is the most common type of collateral. It can include your home, car, or other property.

Stocks and bonds: These can be used as collateral for some loans, such as margin loans.

Life insurance policies: These can be used as collateral for some types of loans, such as loans to cover funeral expenses.

Cash deposits: These can be used as collateral for some types of loans, such as business loans.

Conditions

The fifth pillar is Conditions, which refers to the economic conditions when the loan is made. When assessing the needs pillar, lenders may consider factors such as inflation, high inflation, and unemployment.

Generally, borrowers are more likely to be approved for loans and receive favorable terms when economic conditions are good. Lenders are more confident that borrowers can repay their loans when the economy is doing well.

However, there are some exceptions to this rule. For example, during a recession, lenders may be more willing to approve loans to borrowers with solid credit histories and good employment prospects. It is because lenders know that these borrowers are more likely to be able to repay their loans, even if the economy takes a turn for the worse.

The conditions pillar is an essential part of the creditworthiness assessment process. By understanding the conditions pillar, borrowers can better understand how their creditworthiness is affected by economic conditions.

Conclusion

The five pillars of credit are a valuable tool for lenders to assess borrowers' creditworthiness alongside using alternative data, championed by Oystr Finance, which is fast changing the dynamic landscape of lending. However, it is essential to remember that no single pillar guarantees repayment. Lenders should always consider all the information available before making a lending decision.

To read more on how to scale your lending business as a lender? Visit here.